Approx. 87% of Americans have less than $20,000 in savings. If you are one of them, you may be looking for ways how to save 20000 in 6 months. Maybe you would like to create an emergency fund or just upgrade your overall budget. Or, you may have made some bad financial decisions in the past. You may be spending too much time keeping up with the times and looking for ways to get back on track.

In this article, you will learn how to save 20000 in 6 months. Specifically, I shared 10 tips that you can use today to start the savings process. At the end of this article, you should have a better understanding of what you can do to save extra money and put some extra money into your savings account.

How to Save 20000 in 6 Months?

You may decide that saving 10% is real and you need to save $ 20,000 in 6 months. This means you need to save $ 3,333 a month or about $ 833 a week. One of the biggest factors in your success when you are trying to save money quickly for a home is having realistic expectations and goals.

Once you have decided on your goal of saving it is time to make a practical plan to save your house. Now is the time to throw all your energies into earning more money, reducing costs, and saving every dollar. I know it is probably hard to imagine saving $ 800-1600 a week, but if you are dedicated and willing to put in the work, you are likely to save a lot of money really quickly in your home. Follow these best 10 Tips to save 20000 in 6 months.

01. Automatically set your savings

Start saving money by performing the process automatically. For example, suppose you get $ 1000 in your weekly payment for your work after taxes and deductions. You usually spend $ 600 on housing costs and $ 400 on you.

You can set up your bank account to automatically transfer money to a savings account for each payment day. For example, you could offer $ 250 in savings, thus saving $ 250 that you can spend on yourself.

Although you can do this in person, performing the procedure automatically prevents you from forgetting. It also reduces the temptation to skip the moon. Because the money is not in your test account, you will not be tempted to spend it.

02. Make a budget to save 20000 in 6 months

Your spending budget should be empty bones. Every little extra money needs to go into savings. To complete this step you must have a solid vision of your future home. I have all sorts of budget posts that I will link to below, but I have found that budget planning is very personal to you. Everyone is budgeting a little differently and it is important to find a budget plan that works for you.

I personally prefer to use a percentage-based budget at this point in my life but have used the envelope system, excel spreadsheets, and Quicken in the past. Find a way to budget your money and work hard. If you can work hard for six months I can assure you that you will be shocked at how much you save.

Budgeting is an effective tool to help you stay on track. There are various budgeting strategies available, although you may want to consider the 50/30/20 rule to get started. This law says:

- 50% of your total income goes to expenses

- 30% goes to personal use

- 20% goes to savings or debt repayments

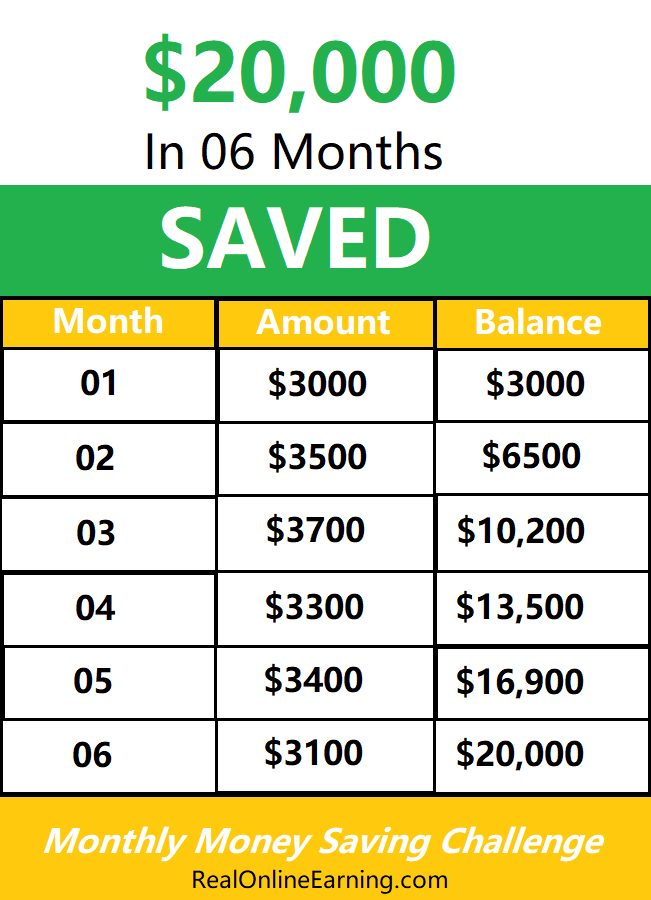

Creating a budget requires that you carefully consider your current income. It can also help keep you accountable and prevent overspending. See below money saving challenge chart about how to save 20000 in 6 months.

03. Review the monthly subscription to save 20k in 6 months

Another way to save money is to check your monthly subscriptions. For example, are you still watching the cable, or are you only using streaming services such as Netflix? Maybe you can cancel one or the other, so you don’t have to pay for both. Are there any streaming services you use more than others?

Even if you cancel the 02 or 03 services, you can save more than $ 150 to $ 200 a month. Also, consider canceling your gym membership if you have one. Instead, you can exercise at home or in the park.

04. Shop at inexpensive grocery stores

Another way on how to save 20000 in 6 months is to Shop at inexpensive grocery stores. Food can be very expensive if you are not careful. Instead of buying chains from an expensive grocery store, try looking for other cheaper alternatives. Your small initiative will you to achieve your goals easily.

05. Earn extra money will help you to save 20000 in 6 months

If you live on a paycheck, you may have to increase your income to save money. One way to do this is to pick up the chaos on the sidewalk. The side hustle is a job that works beyond your full-time job.

Even if you only earn $ 1000 a week, you will still have an additional $ 40,000 a year. Putting this money directly into savings can improve your entire financial life.

06. Start an side business

Well, this is all my favorite way on how to save 20000 in 6 months. I hope I can inspire some of you to start an Etsy business! You can sell digital printable files and I LOVE IT! My printable items can be printed T-shirts, hoodies, mugs, etc. Set profit margin minimum $7-$15 and make over $ 3,450 a month!

The caluculatoin is:

- 8 products x $15 = $120 daily

- $120 x30 days = $3, 600 in a month

- 230 products x $15 = $3,450 in a month

- $3,450 x 6 month = $20,000 in 6 months

To achieve this goal, you have to sell at least 230 products in a month that means approx. 8 products daily which a profit margin is $15. You have to do paid ads campaign to promote your products so that you can generate more sales. Now, it sounds easy! To get better results, your ads campaign budget should be a minimum of $1000 – $2000 dollars.

I am not a graphic designer but it was very easy to print in print using a free online tool. I uploaded the file to my Etsy store and my customers were able to download the printable hundreds of times after that without the slightest action from me.

I don’t have to do anything to take care of the store but answer customer service queries and get the query only once in a few months.

07. Start a blog site to make 20000 in 6 months

There is nothing that keeps me more responsible for saving than sending my numbers online each week. At first, it was kind of embarrassing to put me there online but I’m so glad I did. Blogging encouraged me to reach my financial goals. This is a nice way on how to save 20000 in 6 months.

I also make extra money on the side by blogging. I started making a few hundred dollars a month and now I am a six-priced blogger. It took three years from a few hundred dollars a month to many thousands but it is possible if you are willing to continue with it and not stop studying.

If you want to learn more about starting your own blog, read this article. How to Create a Blog for Free on Google and Earn Money?

08. Sell unwanted items to make $20000

If you have unwanted items or clothes in your home, sell them to help generate income. These items do not gain value by staying in your house unused. Clothes, shoes, bags, furniture, and electronics can all be sold on sites like Craigslist, eBay, Poshmark, etc. This will help you to save 20000 in 6 months.

09. Reduce your electricity bill & Telephone bill to save money

There are a few ways you can reduce your electricity bill. Disassembling the electrical equipment may stop the phantom electricity, which is where the electricity is still used or turned off. Of course, turning off lights and utensils when you are not using them is a pleasant smell too.

One way to save more is to switch to fans instead of using a fan if possible. You can save telephone bills by using internet-based software such as messenger, WhatsApp, Skype, etc.

10. Save 20k in 6 months by preparing food in home

Do you find yourself ordering take-out because you do not like to cook? You are not alone. In fact, Americans spend more than $ 2,000 a year on unused food. Yes! Dietary planning can prevent you from spending money every month on perishable food because your food will be prepared in advance.

Preparing food saves time and helps you stick to your monthly budget. Choose a day, prepare your weekly meal, and see how it simplifies your life and increases your savings. And try to avoide restaurant foods in these 6 months. If you follow these 10 tips on how to save 20000 in 6 months, you can reach your goal easily.

FAQ of Saving 20,000 in 6 Months

Why saving money is important?

Saving money is important from a long-term and short-term perspective. From a long-term perspective, it is important to focus on retirement savings. You need to have enough money to pay for your basic expenses and medical bills when you retire. A trusted planner or advisor can give you sound financial advice about your investment and retirement plans.

From a temporary point of view, saving money is important because it provides comfort and flexibility. If you know you have cash in a bank account, you do not need to stress when unexpected expenses arise. For example, if you find that your car needs new tires, you can relax knowing that you already have money in your payroll account. This prevents you from placing a purchase on a credit card.

If you use a credit card, you are actually borrowing money from your bank. If you do not pay your balance in full before the due date of your statement, the lender will charge interest on the loan. Credit cards usually have high-interest rates. Interest includes, which means interest rates over interest.

Once you have taken out a credit card debt, it can be difficult to get out of it. That doesn’t even consider the other monthly debt obligations you may have, such as student loans and car payments. Having money set aside makes it easier to pay off your debts and reduces your chances of getting extra debt.

Buying a home was a way to build a fortune

Real estate is one of the cornerstones of wealth creation in the US – and like many other forms of financial security in the United States. Many homes within my budget may need repairs or older models, which the Victorians did not attract.

I would not say I had an expensive taste, but many of the new homes I loved were beyond my ability. When I found out that I could build and repair a house on my own without breaking the bank, it was like stealing. I decided to talk to a dealer to learn more so that I could set a goal for future savings.

I would need only a $ 5,000 deposit, which was important, but that was no longer possible. With that in mind, I took the reins and am currently in the process of building a new house worth less than $ 210,000. I knew that I would have to pay the bills, the furniture, and the transportation costs, but I was still far from achieving my goal.

Final Words on How to Save 20000 in 6 Months

I know that doing the aggressive goal of saving 20,000 in 6 months needs a lot of work. However, if you follow these tips, you will be able to save 20 thousand dollars in 6 months. Getting out of debt can be an important part of saving even more. If a credit card debt prevents you from building up your savings.

Depending on your financial situation, you may cancel your holiday tour to save money. The important thing is to make the jump and start making sacrifices now. If you can save a lot of money now, you will be better off when it comes to making a small payment for your new home.

Hopefully, you learned how to save 20000 in 6 months. Especially if you do not have a lot of money in your testing account. However, with the 09 tips I have outlined, achieving your savings goals can be more accomplished than you think.

You May Like to Read Articles

- How to save 5000 in 6 months?

- How to Save Money with 20000 Salary?

- How to Save 10k in 6 months?

- How to Make 20k in a Month?

You have a good idea, but time to time every body changes, i mean unexpected time for everyone. So be wise you save or you waste!