Do you know how to save 5000 in 6 months? In this article, I will share today how to save 5k in 6 months. and even how to save $5,000 in 3 months. Read the full article to know how to save $5000 in 6 months. Can you save $5,000 in six months even on a lower income? Yes, it’s possible. Let’s see how!

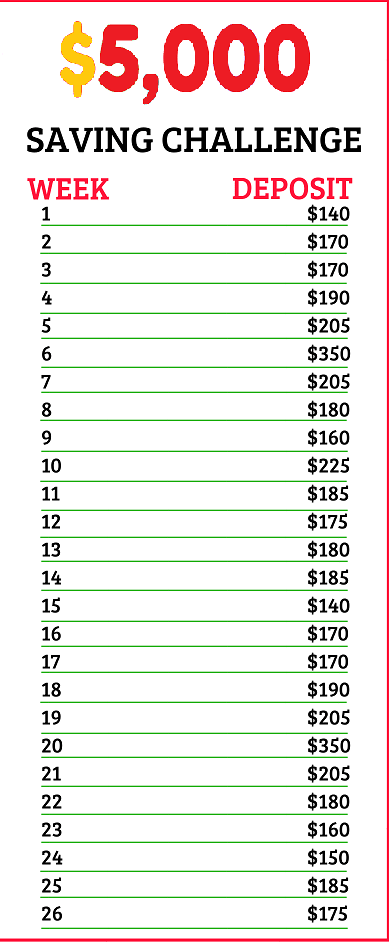

The economic crisis and hardships over the past year have shown us that being financially responsible and having emergency savings is much smarter now than ever before. Many people search on google “how to save 5000 in 6 months chart” or “how to save 5000 in 6 months envelope” and “how to save 5000 in a year”.

How to Save 5000 in 6 Months? -08 Ways to Save 5k dollars

While you may want to save extra money for special expenses, or just a rainy day, you may wonder if it is easy to save $1000, $2500, or $5,000 in 06 months if you are on a tight budget. The answer is yes! Even if your family income does not leave much room for movement, there are many small ways to save money. Here are 08 Ways to save $5000 in 6 months.

01. Small Amounts Can Really Add Up

While saving $ 5,000 may seem like a big deal, breaking it down into smaller pieces makes it much easier. To save $ 5,000 in 06 months, you will need to save $ 833 dollars a month or just $ 27.75 a day. This is less than the cost of a lot of food in a restaurant! If you have a family of four, this is just $ 6.94 a day to save each family member.

You could cut this extra money off completely, or find additional ways to earn more money without having to change your family’s lifestyle. Here’s how to get started on your savings. This is the first step on how to save 5000 in 6 months.

02. Review and Renegotiate your Bills to Save 5000 in 6 months

When did you last update your bills to see if you could change your plans and pay less? Some of the areas to consider are your insurance plans, your mobile plan, or other expenses. Shop online to see if there are any less expensive alternatives out there and if your family can benefit from switching suppliers.

Can you save by changing carriers, replenishing your loans, or updating the services you have? By recently changing our mobile phone system we have been able to save $ 68 a month and add two lines for kids.

We were also able to cut a monthly service costing $ 37 per month by getting another free option. That is $ 444 a year that we can pocket without losing anything! Don’t want to change providers? Call their customer care and tell them you are thinking of canceling and see if they can offer you a competitive program or higher prices. All you need is a phone and you may be surprised at how much you can save.

Not sure where to start to review and discuss your debts? Deciding can help negotiate your debts, unwanted subscription cancellations, and more. It is a very effective way on how to save 5000 in 6 months.

03. Cut Costs on Groceries and Household Essentials

Do you know how much your family spends on food and daily necessities? The daily necessities your family uses like shampoo, razors, and toilet paper can really add up! If you have never followed these costs, you may be surprised at how much they cost each month! Here are some simple ways to save money for these expenses.

Find ways to save in your stores. The cost of food is often one of the biggest family expenses near rent or mortgage. The good news is, however, that it can be easy to save 20% -30%, or more on the cost of supporting your family with just a little planning.

Using coupons and food-saving apps can provide great savings, and the good news is that they are easy to use! Many coupons are digital and if you have a smartphone, you can save money. The most common misconception is that there are only coupons for unhealthy, used products.

This is simply not true! There are coupons and apps that can help you save money on shopping, even if you are following a healthy lifestyle. Over the past week, I have been able to save more than 70% on food items including turkey grains, vegetables, fruits, milk, and grains.

I bought a lot of my family’s favorite things, I didn’t pay the full amount and I was able to pocket the money I had added to our emergency fund. See this list of healthy food budgets for suggestions on organizing your shopping list. This is the most effective way on how to save 5000 in 6 months.

04. Reduce unnecessary expenses to Save $5000 in 6 months

If you were taking your daily coffee, did you know that your daily caffeine habit can cost you about $ 1500 a year? Why not learn to make a quality cup and take it with you to the tourist? Catching lunch on a trip? That lunch can cost you $ 2000 or more a year! Ordering out or eating out can add thousands of dollars a year more.

While you do not want to be completely self-sacrificing, reducing your family’s outdoor expenses can save you a lot of cash and help you live a healthier life. We’ve found many copycat recipes for our favorite restaurants that we can make at home.

This way we can still enjoy our favorite food, and save money at the same time. It is one of my favorite ways how to save 5000 in 6 months.

05. Find ways to get rid of waste to Save 5000 in 6 months

Did you know that the average family of four wastes more than $ 1500 on unused food every year? The fact is that this waste can add up a lot! By looking at how your family uses food and other products, it can reveal some great ways to save money.

Do only what you need. While this may seem obvious, the fact is that the size of parts in America is much larger than in most other parts of the world. We have a tendency to cook and serve more than we need to, and this often leads to many leftovers that are inedible and often thrown away.

I have reduced the amount of food I make in each meal and you know, no one in our house has ever seen it! Instead of extra sides, lots of bread, and large bowls, I focus on preparing what I know is going to be eaten. This leaves very little at the end of the meal and leaves very little waste.

Find creative ways to use the rest. Instead of leaving the leftovers in the refrigerator or in the trash, find ways to use them properly. Can those vegetables that have been digested from a salad overnight be frozen to make into a soup or a casserole?

Can that remaining chicken breast make another meal by adding some noodles and vegetables? One of my favorite foods to cut is to cut and freeze the fruit just before it spoils. I have bags in the fridge that I put in them, and these make excellent and easy smoothies.

06. Select Side Gig to Save 5k in 6 months

With all the savings you have, are there any small ways you can earn extra income to help you meet your savings goals? Absolutely! By taking a side gig, you can earn more money by saving, or paying for those unplanned payments. Wondering how to help you on the side even if you work full time? There are many simple ways to earn extra money per hour or less a day.

Whether you find something to make money online, do part-time work on Uber Eats, drive for an hour in the evening with DoorDash or Instacart, sell items online or do online surveys to earn more money after children’s sleep, there are many ways to earn more money than before.

07. Sell Extra Items to Save $5000 in 6 months

Do you have furniture in your basement or a dusty ceiling? Do you still have large numbers of clothes and toys for your grown children? Why not get rid of clutter and make more money by cleaning up after yourself?

I usually estimate $ 100 a month or more by selling items online or at retailers. This is a great way to make more money and also give us more money to spend on new things that my family needs.

Many of us have been selling his old books and old toys and made $ 200 this holiday cleaning his room for things he no longer needs. Not only did she make more money to buy the much-needed item, but I also found a clean room that had won twice!

08. Use investment and return apps

Do you take full advantage of what your family can do from regular family purchases? In addition to the apps that help you save in the store, there are other apps that can help you earn money with the things you do every day. While they can only save a few dollars or a few cents at a time, the total numbers can really add up.

- Invest With Acorns: Have you ever wished you could invest in the stock market if you had more money? Acorn is an exchange app that integrates your purchases and helps you invest your pocket change in the stock market without any work or effort.

- Get Refund Online When You Buy: While you were already repaying your credit card, did you know that you can also repay the money on other savings apps? Another personal favorite is Rakuten. Officially known as Ebates, use Rakuten to get money back by buying online. You will be refunded a percentage of all purchases and receive $ 10 free with just a subscription.

If you are looking for ways to save $ 5000 in six months, the good news is that it is easier than you think. By breaking down your goal and gaining insight into how you spend your money, you can get on your way to saving faster. These are the 08 ways on how to save 5000 in 6 months.

My Suggesstions on How to save 5000 in 6 months

Try to Save storage. Storing a large amount of junk food and household items you do not need to collect. It simply means keeping a small, efficient supply of the products you bought at the best price. This protects you from paying the full amount, prevents unnecessary trips to the store, and keeps things in use when you need them, including emergencies.

Our repository has helped us survive many unplanned job losses over the years and has been helpful in times of recent product shortages. In addition to keeping at least a few purchases a week, I also put in a lot more.

I recently bought a pack of gift knives at holiday approvals for a bargain price of $1 USD per pack. This has given us annual threats to the provision of a standard price package. Who cares to be wrapped in holiday packages?

Cut costs on household items. If you could save hundreds or more of your family’s daily needs, wouldn’t you? The daily necessities of life for your family can be very costly if you do not buy well. By combining and using apps like Target Circle, Ibotta, and Checkout 51, I can buy many products like body wash, razors, laundry soap, vitamins, and more for a dollar penny, or often for free.

The key is to look at deals and keep these intangibles and have sales so that you have more to last until the next sale and you can avoid paying the full amount.

FAQ on How to Save $5,000

How to save 5000 in 3 months?

Just follow these above 08 steps and try to save double the money every month. Reduce your daily expenses such as electronic gadgets shopping, hang out with friends, stop tasting delicious foods and chocolates. Try to reduce mobile expenses and bad habits etc.

How to save 5000 in a year?

Just follow these above 08 steps and try to save half of the money every month and that is very easy! Reduce your daily expenses such as apparel shopping, hanging out with friends, and stop going to restaurants for food and chocolates. Try to reduce mobile expenses and reduce budgets on occasions such as birthday gifts, new year gifts, etc.

Final Words on How to Save $5000 in 6 Months

Most of the time, when we get into extra income, we think it’s a good time to celebrate and increase our spending. This is a terrible mistake. If you continue to increase your spending as your salary increases, you will never be able to move forward. By taking the extra income into my savings account, I was able to achieve many of my annual financial goals ahead of time.

When I received my annual bonus in June, I split the quarter to buy my mom a birthday present and spent some money to improve our home. I deposit all the rest into my savings account. Whenever you start a profitable journey, you will encounter challenges. But if you go through these steps, you will achieve your goal – guaranteed. This is a very important effort and it is probably about changing lives.

Once you have completed this $ 5000 goal, you will be empowered to move on to bigger and better things. The sky is the limit from here. I hope that at least one of these ideas will touch you in this article “how to save 5000 in 6 months” and allow you to take the next steps in your journey to financial freedom, a healthy life, and building the life of your dreams. If you have questions, ask away!

You May Like to Read

- How to Save 10k in 6 months?

- How to Make $5000 Dollars in A Month?

- How to Save 20000 in 6 Months with Chart?

- How to Save Money with 20000 Salary?

All of us try to save money whether is $100, $500, or $5000.