Do you know how to calculate income tax bd 2025-2026 or prepare an income tax return file? Let’s see the income tax calculation example in Bangladesh. First, we need an income tax return form bd and Bangladesh income tax rate to prepare a return file of income tax Bangladesh 2025-2026. Many people search online for “Bangladesh income tax calculator”, “income tax calculator bd”, “Bangladesh income tax calculator excel”, “taxation in Bangladesh book pdf”, etc.

But they forgot. Without learning something, we can’t prepare the income tax return file properly, such as Bangladesh income tax rate, income tax deduction at source in Bangladesh, income tax slab in Bangladesh, etc. Last year, we had the facility to prepare income tax files online. But this year, the website and software have some problems. So, we have to submit the income tax return file manually at your desired Tax Circle Zone.

There are many types of taxes, such as Individual, Corporate, Withholding, Value-Added Tax (VAT), Excise Duty, Customs Duty, and Supplementary Duty.

Income Tax Calculation Example in Bangladesh 2025- 2026

The things we need to prepare an income tax return file. They are:

- eTIN Certificate

- income tax return form bd

- Salary Statement

- Bank Statement

- NID photocopy

- Passport-size photo

- Other documents ( Business/ Agricultural/ House rent, etc, income proof)

and some knowledge about income tax slab in Bangladesh, Bangladesh income tax rate, income tax deduction at source in Bangladesh.

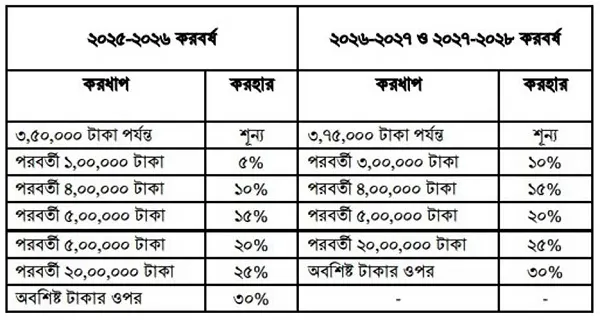

Finance Adviser Salehuddin Ahmed proposed in June 2025, the tax-free income threshold of male taxpayers from Tk. 3 lakh 50 thousand will be unchanged in the next fiscal year. For new taxpayers minimum tax is 1000 Taka.

As part of the proposed measures, the tax-free income threshold for individual taxpayers has been increased from Tk 3.5 lakh to Tk 3.75 lakh for the assessment years 2026–27 and 2027–28. In addition, taxpayers officially recognised as “July Warriors”—those injured during the July 2024 mass uprising—will benefit from a higher tax-free income limit of Tk 5.25 lakh.

Income in the next slab of Tk 100,000 will be taxed at 5%, followed by 10% on the next Tk 400,000. The subsequent Tk 500,000 will be taxed at 15%, the next Tk 500,000 at 20%, and the following Tk 2 million at 25%. Under the newly proposed income slabs, any income exceeding Tk 3.85 million will be subject to a 30% tax rate.

Income Tax Rate That Needs To do Income Tax Calculation BD

| Total Income in A Year | Tax rate |

| On first Tk. 3,50,000 | Nil |

| On next Tk. 1,00,000 | 5% |

| On next Tk. 4,00,000 | 10% |

| On next Tk. 5,00,000 | 15% |

| On next Tk. 5,00,000 | 20% |

| On following Tk 20 lakh | 25% |

| On the balance of total income | 30% |

To popularise the option of online payment of taxes and online submission of tax return among the taxpayers, he also proposed a tax rebate of Tk. 2000 to all the taxpayers of Bangladesh who will file their income tax returns online for the first time.

Income Tax Calculation Example in Bangladesh 2025-2026

To do an income tax calculation example in Bangladesh, we need the first eTIN certificate and income tax return form bd. If you need eTIN certificate click here.

Income tax return form bd or Income tax return form bangla bd

Income tax return form bd are of 2 types. They are income tax return form bd (English) and income tax return form Bangla bd. Also has an income tax return form bd old version and the new version. We shared a new version of the income tax return form Bangla bd 2025.

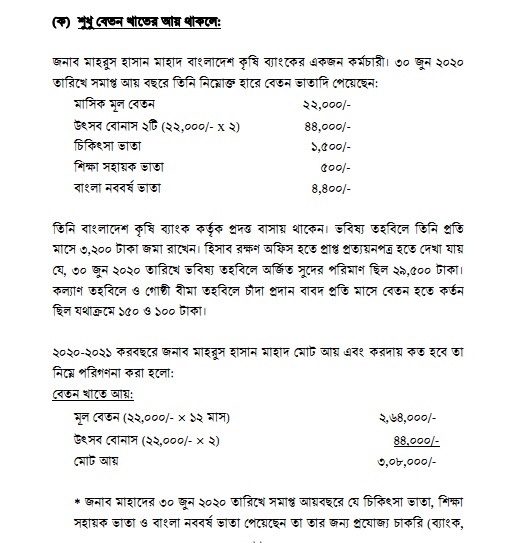

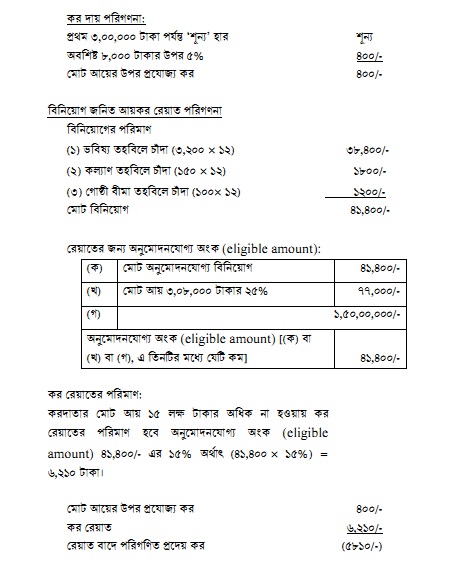

Let’s see the income tax calculation example in Bangladesh below: Example of Salary Based Income Tax Bangladesh 2025-2026. After that, we included a video on income tax calculation bd to clear up all your confusion.

SCHEDULES SHOWING DETAILS OF INCOME TAX BANGLADESH

| Pay & Allowance | Amount of Income (Tk.) | Amount of exempted income (Tk.) | Net taxable income (Tk.) |

| Basic pay | 6,00,000 | 6,00,000 | |

| Special pay | |||

| Dearness allowance | |||

| Conveyance allowance | 48,000 | 30,000 | 18,000 |

| House rent allowance | 3,60,000 | 3,00,000 | 60,000 |

| Medical allowance | 72,000 | 60,000 | 12,000 |

| Servant allowance | |||

| Leave allowance | |||

| Honorarium / Reward/ Fee | |||

| Overtime allowance | |||

| Bonus / Ex-gratia | 1,50,000 | 1,50,000 | |

| Other allowances | 30,000 | 30,000 | |

| Employer’s contribution to Recognized Provident Fund | 60,000 | 60,000 | |

| Interest accrued on Recognized Provident Fund | |||

| Deemed income for transport facility | |||

| Deemed income for free furnished/unfurnished accommodation | |||

| Other, if any (give detail) | |||

| Net taxable income from salary | 13,20,000 | 3,90,000 | 9,30,000 |

Statement of income during the income year ended on …30/06/2025………………………………………….

| Heads of Income | Amount in Taka |

| Salaries : u/s 21 (as per schedule 1) | 9,30,000 |

| Interest on Securities : u/s 22 | 9,500 |

| Income from house property: u/s 24 (as per schedule 2) | |

| Agricultural income : u/s 26 | 14,400 |

| Income from business or profession : u/s 28 | |

| Share of profit in a firm : | |

| Income of the spouse or minor child as applicable : u/s 43(4) | |

| Capital Gains : u/s 31 | |

| Income from other source : u/s 33 | 23,000 |

| Total (serial no. 1 to 9) | 9,76,900 |

| Foreign Income: | |

| Total income (serial no. 10 and 11) | 9,76,900 |

| Tax leviable on total income | 76,060 |

| Tax rebate: u/s 44(2)(b)(as per schedule 3) | |

| Tax payable (difference between serial no. 13 and 14) | 39,782 |

| Tax Payments: (a) Tax deducted/collected at source (Please attach supporting documents/statement) Tk …………..15,400 (b) Advance tax u/s 64/68 (Please attach challan ) Tk ………….15,000 (c) Tax paid on the basis of this return (u/s 74) (Please attach challan/pay order/bank draft/cheque)Tk …………9,382 (d) Adjustment of Tax Refund (if any) Tk ………….. Total of (a), (b), (c) and (d) | Tk. ………39,782 |

| Difference between serial no. 15 and 16 (if any) | |

| Tax exempted and Tax-free income | Tk. …………….. |

| Income tax paid in the last assessment year | Tk. …………….. |

Schedule-3 (Investment tax credit)

| 1. Life insurance premium Tk ………………..20,000……………….. 2. Contribution to deferred annuity Tk …………………………………. 3. Contribution to Provident Fund to which Provident Fund Tk …………………………………. 4. Self contribution and employer’s contribution to Recognized Provident Tk …………………1,20,000………………. Fund 5. Contribution to Super Annulation Fund Tk …………………………………. 6. Investment in an approved debenture or debenture stock, Stock or Shares Tk …………………………………. 7. Contribution to deposit pension scheme Tk ……….60,000………………………… 8. Contribution to Benevolent Fund and Group Insurance premium Tk …………………………………. 9. Contribution to Zakat Fund Tk …………………………………. 10. Others, if any ( give details ) Tk …………………………………. Total Tk …………………………………. |

| 1. (a) Business Capital (Closing balance) Tk. …….. (b) Directors Shareholdings in Limited Companies (at cost) Tk. ……… Name of Companies Number of shares |

| 2. Non-Agricultural Property (at cost with legal expenses ) : Tk. ……… Land/House property (Description and location of property) |

| 3. Agricultural Property (at cost with legal expenses ) : Tk. ……… Land (Total land and location of land property) |

| 4. Investments: (a) Shares/Debentures Tk. ……….. (b) Saving Certificate/Unit Certificate/Bond Tk. ……1,00,000….. (c) Prize bond/Savings Scheme Tk. ……1,44,000….. (d) Loans given Tk. ………..22,000 (e) Other Investment Tk. ………..2,00,000 Total: Tk……………….4,66,000 |

| 5. Motor Vehicles (at cost) : Type of motor vehicle and Registration number 6. Jewellery (quantity and cost) : 10 Vori Gold (marriage gift) | Tk. Tk. | ……… …unknown…… |

| 7. Furniture (at cost) : 8. Electronic Equipment (at cost) : TV, Fridge (marriage gift) | Tk. Tk. | ……… ….unknown….. | ||

| 9. Cash Asset Outside Business: (a) Cash in hand | Tk. | ………..6,95,00 | ||

| (b) Cash at bank | Tk. | ……….. | ||

| (c) Other deposits | Tk. | ……….. | ||

| Total = | Tk. | ……… |

| B/F = Tk. ……… 10. Any other assets Tk. ……1.20,000… (With details) Total: Tk……14,81,900 | ||||

| Total Assets Tk. ……… 11. Less Liabilities: | ||||

| (a) Mortgages secured on property or land Tk. ……….. (b) Unsecured loans Tk. ……….. (c) Bank loan Tk. ………..1.85,000 (d) Others Tk. ……….. Total Liabilities Tk. ………1,85,000 12. Net wealth as on last date of this income year (Difference between total assets and total liabilities) Tk. ………12,96,900 13. Net wealth as on last date of previous income year Tk. ……….. 14. Accretion in wealth (Difference between serial no. 12 and 13) Tk. ………12,96,900 15. (a) Family Expenditure: (Total expenditure as per Form IT 10 BB) Tk. …….6,70,000 (b) Number of dependant children of the family: | ||||

| Adult 02 Child 01 | ||||

| 16. Total Accretion of wealth (Total of serial 14 and 15) Tk. ………19,66,900 17. Sources of Fund : (i) Shown Return Income Tk. ………..9,76,900 (ii) Tax exempted/Tax free Income Tk. ………..3,90,00 (iii) Other receipts Tk. ………..6,00,000 Total source of Fund = Tk. ……….19,66,900 18. Difference (Between serial 16 and 17) Tk. ………. I solemnly declare that to the best of my knowledge and belief the information given in the IT-10B is correct and complete. Name & signature of the Assessee Date ……………….. · Assets and liabilities of self, spouse (if she/he is not an assessee), minor children and dependant(s) to be shown in the above statements. *If needed, please use separate sheet. |

| Income Tax Calculation BD FORM | Form No. IT-10BB |

| Serial No. | Particulars of Expenditure | Amount of Tk. | Comments |

| 1 | Personal and fooding expenses | Tk. 1,80,000 | |

| 2 | Tax paid including deduction at source of the last financial year | Tk. 30,400 | |

| 3 | Accommodation expenses | Tk. 1,80,000 | |

| 4 | Transport expenses | Tk. 1,74,500 | |

| 5 | Electricity Bill for residence | Tk. 15,000 | |

| 6 | Wasa Bill for residence | Tk. | |

| 7 | Gas Bill for residence | Tk. 10,000 | |

| 8 | Telephone Bill for residence | Tk. 10,000 | mobile |

| 9 | Education expenses for children | Tk. 20,000 | |

| 10 | Personal expenses for Foreign travel | Tk. 10,000 | loan interest |

| 11 | Festival and other special expenses, if any | Tk. 40,000 | |

| Total Expenditure | Tk. 6,70,000 |

| Total income is shown in Return: Tk …………9,76,900 Tax paid: Tk ………………………39,782 |

| Net Wealth of Assessee: Tk ………………….12,96,900 |

| Date of receipt of return: ……………………………………… Serial No. in return register ………………….. |

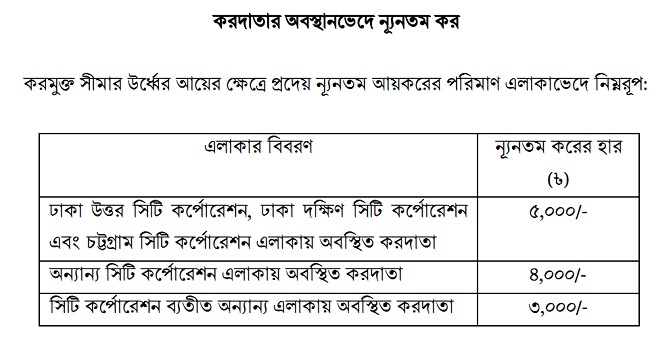

Although his tax calculation is negative, he has to pay a minimum tax of 5000 tk if he stayed in Dhaka Zone. Because his income crossed in income tax limit of 400 tk. See the video below for an income tax calculation example in Bangladesh.

Income Tax Calculation Example in Bangladesh 2025-2026 Video

After submitting your income tax Bangladesh 2025-2026, don’t forget to receive an Acknowledgement Slip, which is proof of your income tax return file. Always collect a return file photocopy of your last year’s income tax calculation bd which will help you to prepare an income tax file for next year. If you need it, you can also collect an income tax certificate bd.

If you submit zero return tax within 3 years consistently and preserve the previous copy of the income tax calculation bd. From next year, you will not need to submit an income tax return file.

I hope this post and video of income tax calculation examples in Bangladesh 2025-2026 will help you to find out how to prepare a return file of income tax Bangladesh. The last date for submission of income tax in Bangladesh is 30 November (Every year).

Income tax calculation bd tag:

income tax return form bd pdf bangla, income tax certificate bd, income tax Bangladesh, income tax slab in bangladesh, income tax return Bangladesh, income tax bd, income tax calculation bd, income tax calculator bd, income tax return form bd, bangladesh income tax rate, income tax gov bd, bangladesh income tax calculator.

Bangladesh income tax calculator excel, taxation in bangladesh book pdf, income tax deduction at source in bangladesh, income tax calculation bd, income tax return form bangladesh, income tax return form bangla bd, income tax calculation example in bangladesh, taxation in bangladesh pdf, Online income tax bangladesh.

You May Like To Read Articles:

- How I made 200 USD In A Day From Bangladesh?

- 25+ Profitable Small Business Ideas In Bangladesh

- How to Earn Money Online in Bangladesh Without Investment

- How To Earn Money From Facebook Without Investment?

Thanks for sharing the Income Tax Calculation with Example. It helps me to prepare the Income Tax Return file.